Let’s face it. The utility industry is asset-intensive. Even with disruptions to centralized supply and delivery models, there will still be physical assets to maintain.

Over the last three decades, asset management practices have evolved from routine maintenance to asset performance management (APM). With advancements in sensor deployment and connection (IoT), machine learning, and cloud, many of the big vendors are offering APM platforms for utilities.

The question for APM platform providers is how quickly the utility market will develop. For the utilities, it is what whether an APM platform is the best way to enable evolving asset management best practices.

Other asset-intensive industries seek to lower their risk of asset failure and associated safety, economic and environmental consequences, while at the same time reducing maintenance and capital costs. Utilities have the same objectives plus an extra emphasis on reliability. Asset management best practices include condition-based, predictive, reliability-centered, and prescriptive maintenance, and now and, in its latest incarnation, APM. It’s not necessarily a linear path. Most utilities will adopt multiple practices and in no consistent order across the industry.

So…what is APM?

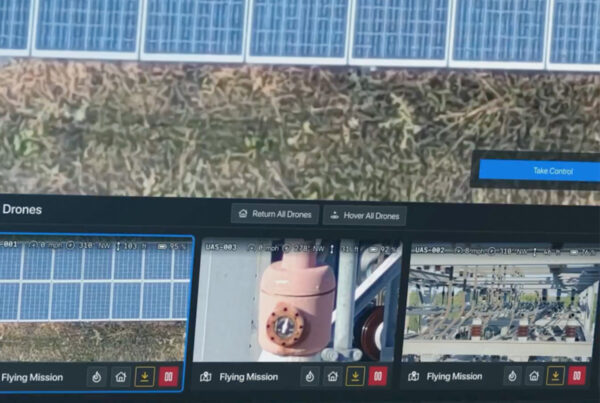

The moniker APM, coined by software vendor Meridium in the early 2000s, has now come into the common parlance. APM is a set of enabling technologies that require connections to multiple data sources (IoT, SCADA, work and asset management, inspection and test data, outage management), data stores (cloud or on-premise, data lakes), engineering models, analytics (machine learning, optimization) and visualization (graphical display, geo-mapping). APM is used to arrive at the optimal approach to potential failure, in the context of risk and criticality. It’s not just about maintenance; APM promises to deliver on improved operations, planning and investment as well (still an unmet promise in most cases).

There are quite a few cloud-based APM platforms, such as GE Digital’s Predix, Aveva’s APM, ABB’s Ellipse APM, C3 IBM Maximo APM, and Oracle’s APM, being offered to utilities. The secret sauce for APMs served up by manufacturers is the set of models that assess the health of their asset products.

For example, manufacturers may have vetted models for determining when capacitors, transformers, and breakers are about to fail. In theory, a utility’s historical data on equipment performance, no matter who the manufacturer is, could be used to train these types of models. Software vendors’ advantage is their experience with utility-specific software applications (work and asset management, outage management) cloud platforms, integration and more recently IoT integration.

A temperamental market

Speaking of GE Digital, there’s been much buzz about Predix’s fate, given the company’s performance. GE bet big in creating Predix, spending lots on building a cloud platform, hiring digital experts and acquiring companies (Meridium, BitStew, ServiceMax). Expectations were high – $4 billion in revenue by 2020. [See GE, The 124-Year Old Software Startup].

Last spring, there was talk of selling the division. Instead, GE will spin off GE Digital and the Predix platform to a new independent company owned by GE. The question remains, though, whether this market will grow fast enough and big enough to meet expectations, for GE, as well as others in this somewhat crowded space.

From a utility perspective, an APM’s security, ease of integration, graphic visualization, and analytics, are important, but not necessarily in that order. Cloud is still a security concern for many (that’s why late last year GE started offering Predix on a private cloud). However, since APM platforms are advisory—not control—systems they may pass NERC CIP protected information standards.

Platforms developed by manufacturers do not have the IoT integration capabilities that software vendors have so integration can be difficult. GE Digital acquired BitStew for that reason. Graphics visualization and geo-mapping are popular, especially for utilities that are “visualization poor.” Engineers are particularly fond of tools that let them drill into asset health analytics.

For the asset manager, transparency in the models (for example, how is the magnitude of risk and criticality calculated) is essential, as is the ability to change inputs and parameters in the models. Then there is the question of coverage. How vital are engineering models? What if a manufacturing company’s APM platform does not cover all the assets/equipment that a utility owns? It appears right now, utilities that have decided to take the APM plunge, can wait for their provider, or perhaps the magic of AI to work it out.