Investors will be looking more closely at utilities’ exposure to climate risk as an input to their investment decisions.

Climate risk has shareholders, bond holders, insurance companies and ratings organizations worried. Note the recent statement by Larry Fink, CEO of investment management firm BlackRock. Fink backed the U.K.’s move to make the reporting of corporate risk related to climate change mandatory. Investors will be looking more closely at utilities’ exposure to climate risk as an input to their investment decisions. They will want to know “what’s under the hood”–how utilities assess the probability and magnitude of the impact of climate change and how they plan to address risks. Analytics are bound to be involved.

As regulated entities, utilities have had success accessing capital. In 2020, utilities have raised more equity than in 2019.[1] Moving forward, that likely will change. Wildfires, severe storms, flooding and long-term changes in temperature (physical risks) are no longer outliers. Plus utilities face risks associated with the transition to low-carbon energy sources. Think stranded assets, decommissioning, and investments in electrification and renewable/distributed energy resource integration.

In addition to investors, a few utility regulators are looking at climate risk reporting. In August, the California Public Utility Commission ordered investor-owned utilities to report their climate risks every four years, especially the impacts on vulnerable communities. The New York Public Services Commission (PSC) opened a proceeding in October[2] to consider requiring utilities to report climate-related risks annually in line with recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

There is a lot of talk these days about the TCFD framework. This framework is a step beyond voluntary disclosure of progress against climate-related targets such as greenhouse gas reductions (GHG) — in other words, historical reporting. The TCFD framework is different in that it is forward-looking and emphasizes the relationship between climate risk and financial stability. It calls for quantification of the impacts of climate risk on company revenue, expenditures and the balance sheet.

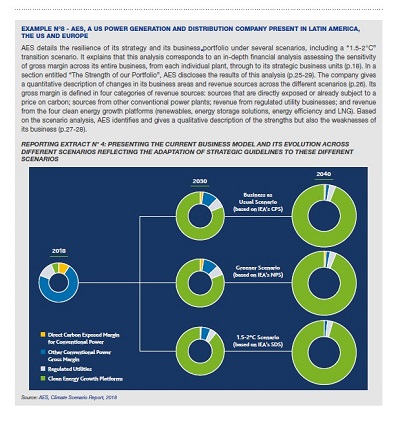

Here’s how AES Corp., an early supporter of TCFD, connected the dots between climate risk and financial impact:

Xcel Energy is another utility that has adopted the TCFD framework.[3] Xcel “completed a scenario analysis to ‘stress test’ the effectiveness of Xcel Energy’s corporate strategic priorities, climate strategy and risk management processes” against low-carbon transition and physical risks. Scenario analysis is a key element of the TCFD framework.

The scenario analysis process is complicated in general, and particularly so for utilities. For transition risk, Xcel chose to draw from the International Energy Agency’s (IEA) 2019 World Energy Outlook (WEO) data and descriptions to assess short-term (to 2030) and long-term (to 2040) possible outcomes. Xcel looked to IEA’s Sustainable Development Scenario (SDS) to determine the trajectory of energy demand, renewable adoption, use of natural gas, electrification and clean fuels. One limitation is that WEO does not predict future outcomes, but instead explores possible futures.

For physical risk, Xcel uses the Intergovernmental Panel on Climate Change (IPCC), downscaled to regions in the U.S. IPCC also identifies chronic risks associated with the course of temperature increases.

However, the regions are not granular enough to predict physical risks to Xcel service territories, especially event-driven impacts such as severe weather or wildfire.

Global climate scenarios do not get down to the specifics of a utility’s circumstances. Xcel’s analysis also relies on proprietary, internal data and analytics related to areas such as energy demand, the cost of resources, or changes in public policy and regulation. Xcel uses data and analytics to “forecast what is needed to plan and operate our electric and natural gas systems.”

Professional service firms, startups and established analytics vendors are looking to provide advice, tools and platforms to make the process more efficient and transparent. Be on the lookout for additional blogs on this topic.

[1]Why capital markets are continuing to finance utilities facing rising flood and other climate change impacts, UtilityDive, November 2020.

[2]PSC Case No. 20-M-0499.

[3]Managing Risk and Opportunities in a Clean Energy Future: A Report Based on the Recommendations of the Task Force on Climate-Related Financial Disclosure”.